Guest Author

Where Is Your Consumer?

Adam Schumacher

NXT Ascent

May 12, 2021

Too often companies look at customer acquisition too narrowly and place them into two categories: retail-only or direct-to-consumer (DTC). For instance, legacy or incumbent brands may only sell through retail channels. While these brands are highly recognizable at shelf, the retail-only channel may make it difficult for consumers to interact with the brand directly because the retailer becomes that point of contact if they have questions or need guidance.

Conversely, the DTC approach appears to solve for this as “digitally native brands” claim to cut out the retailer and provide the consumer with savings. However, this is not entirely true as the retail margin they’re cutting goes towards paying Google, Facebook or other digital marketing costs. If you are building a brand, especially as a challenger, you may feel some pressure to pick the right approach, but I argue that consumer acquisition shouldn’t be so rigidly divided into two categories. Instead, I advise you to take a closer look at the consumer and I’ll share some of the strategies we’ve adopted for our brands at NXT Ascent.

At NXT Ascent, our modus operandi is “Be available where your customers want to buy.” This means you need to know who and where your customers are. If you can’t answer this, then you can’t sell to them. Secondly, where are they buying and what channels are available to your brand? As I’ve mentioned, there are DTC and retail channels—but there are also online marketplaces such as Amazon, eBay and others. While it is becoming more common for product sellers to utilize these online marketplaces, I would argue they aren’t necessarily equipped to build brands and should be treated like retailers. Whatever channel(s) you take, don’t make it difficult for your target market to buy from you. My first rule of business is always be available to sell.

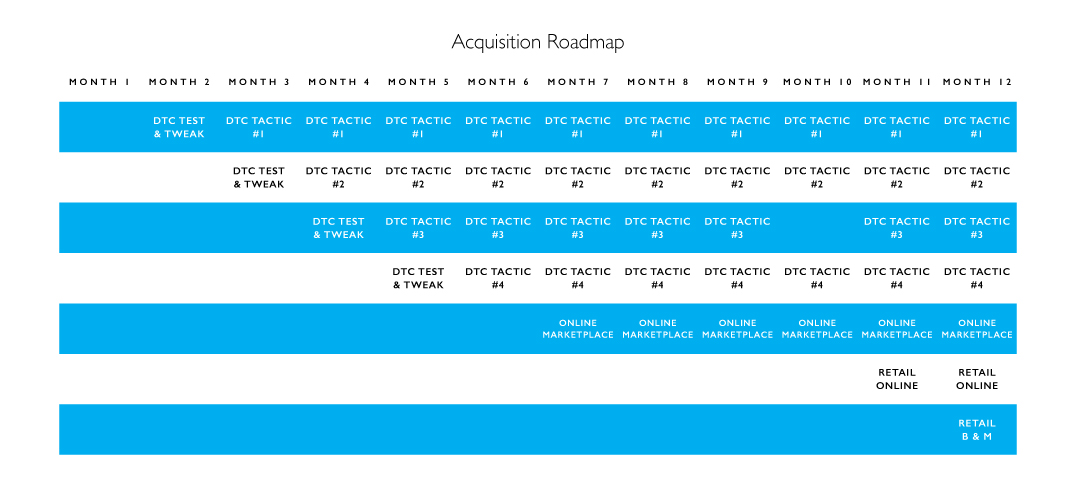

Once you know who and where your customers are, you can build a customer acquisition roadmap and literally overlay it on a calendar. From there, you can create goals, assess results, and iterate and refine throughout the year. For example, we create our acquisition roadmap with financial goals built in by channel. We assess monthly performance metrics and make strategic changes as necessary.

An example of our roadmap may look something like this:

As you can see from the roadmap, we started with a DTC acquisition model in the beginning of the year and then later added online marketplaces, online retailers and finally brick-and-mortar retailers. All our brands start with a DTC model at NXT Ascent. Some brands may stay in DTC for life, whereas others may go on to create their own retail experiences or sell through traditional retail channels. Every brand takes its own path.

However, by starting with a DTC acquisition model, we are able to initiate consumer engagement, build recognition and create buzz, which ultimately builds demand prior to opening new channels. For instance, if we choose to go to online marketplaces or retailers, we want our customers already seeking our product in these channels as opposed to asking our retail partners to do our job for us. Moreover, a significant advantage of DTC is the ability to maintain control over your brand, especially when it comes to retail prices, promotions and product placement. In marketplaces, every competitive product in the world can suddenly appear right next to yours as a “me too” product. Marketplaces offer minimal discernment or selectivity over the products that can be purchased, which is why it is critical to create direct relationships with customers early on with a DTC model as opposed to after you are in retail.

Whether you take the DTC, retail or hybrid approach, it’s important to have a solid understanding of your customer acquisition costs (CACs), which factor all of your acquisition costs per sale. While acceptable to overspend at the onset to launch, CACs have to adhere to a plan or iterate until they get there. For instance, we look at retailers as another acquisition cost. Besides losing some control over prices and promotions, retailers are NOT bad. In fact, good retailers have built substantial trust from their customer base which gives your brand a “stamp of approval.” In doing so, we pay the retailer a margin for accessing their customers and foot traffic as opposed to paying Google or Facebook to acquire the customer.

Scaling is as much an art as a science with navigating channel choices and wisely spending your marketing and customer acquisition dollars. The key is to have a roadmap upfront and make your products available where your customers want to buy. While being a challenger brand isn’t easy, you have the freedom to create unique interactions with the customer and build new experiences along the way.